Can You Use an FSA for Dental Implants? How to Use Your Account for Dental Work

Do you have a tooth that is missing? Or maybe more than one? You might be thinking about getting dental implants. If so, you may ask yourself how you can pay for them. A great way to save money is by using a Flexible Spending Account, also known as an FSA. This article will explain how to use your FSA for dental implants. You will find out if this treatment is covered. You will also learn what steps to follow and how to use your money in the best way. Keep reading to learn how you can get a new smile and save money too.

Table of Contents

What Is a Flexible Spending Account (FSA) in the First Place?

A Flexible Spending Account (FSA) is a special account. You can use it to pay for some medical and dental care bills. You do not pay tax on the money you put into this account. This is a big plus. It means you begin saving money right away. Your job might offer this kind of account as part of your employee benefits. You get to choose how much money to put in the account at the beginning of the year. This money is taken out of your paycheck before you pay taxes. This makes it a tax-free account.

You can use the money in your flexible spending account for many types of health care bills. This can be for things like doctor visits, medicine from the pharmacy, and of course, dental care. The most important rule is that the service must be a “qualified medical expense.” Your employer makes the rules for your plan. But most FSAs follow rules from the government. This special account is a wonderful way to plan for your health bills. It also helps you save money on taxes. It helps you pay for the care that you and your family need.

The money you decide to put into the account is ready for you to use at the start of the year. You can use the full amount you chose to set aside. This is true even if you have not put all the money in yet from your paychecks. This is very helpful for a big treatment like getting a dental implant. You do not have to wait until you save up all the money. Your employer gives you the full amount right at the beginning. This can make getting the dental work you need much easier. Be sure to ask your employer about the details of your plan.

So, Are Dental Implants Covered by an FSA?

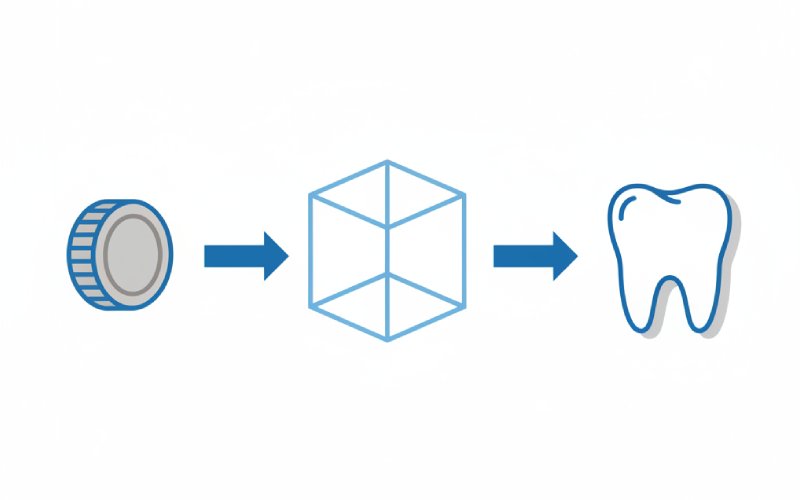

Yes, most of the time, dental implants are covered by an FSA. This is great news if you have to replace a tooth that is missing. The reason they are usually covered is because dental implants are for a medical reason. They are not just to make you look better. A dental implant is used to help your mouth and jaw work properly again. When you are missing a tooth, it can be hard to chew your food the right way. A dental implant works like a real tooth. It helps you eat and speak. This is why it is seen as a necessary dental treatment.

The main rule for an FSA is that the bill must be for medical care. Dental implants are a long-lasting fix for a missing tooth. They help keep your mouth healthy. A missing tooth can make other teeth move out of place. It can also cause the bone in your jaw to get weaker. A dental implant stops these problems from happening. Because of this, implants are seen as a medical need, not something that is just for looks. So, you can almost always use your FSA money to pay for the dental implants procedure. This helps make the treatment easier to pay for.

So, are dental implants covered? Yes, dental implants are covered. You can feel sure about planning to use your FSA funds for this important treatment. This coverage is not only for the implant itself. It can be used for the whole process. This includes the oral surgery to put in the implant post. It also includes the crown that looks like a new tooth. Using money from your account before taxes are taken out makes a big difference. It lowers the total cost you pay yourself. This is a very smart way to handle your dental bills.

Why Are Some Dental Procedures Not Covered by an Account?

Not all dental work is covered by an FSA. The main reason has to do with the difference between a medical need and a choice for looks. FSAs are made to help pay for medical care. This care must treat or stop a disease or a health issue. A treatment must make your health better or help your body work better. If a dental service is only for making you look better, it is usually not covered. These are called cosmetic procedures.

A good example of a cosmetic procedure is teeth whitening. Things like teeth whitening only change how your teeth look. They do not fix a medical issue with a tooth. The main reason for them is to improve how you look. So, you cannot use your FSA to pay for it. The same rule is true for veneers that are only used to make a smile look nicer but do not fix a broken tooth. Your FSA plan will have a list of what it pays for and what it does not. It is always a good idea to look at this list.

This rule helps make sure that the tax savings from FSAs are used for real health care bills. Dental implants are not the same. A dental implant does make you look better by filling a space. But its main purpose is to help your mouth work. It allows you to chew again. It also keeps your jaw healthy. This is why a dental implant is a medical treatment and not just a cosmetic one. The goal is to get your tooth and mouth working normally again.

| Type of Treatment | Main Reason | Will an FSA Pay? | Examples |

|---|---|---|---|

| Needed for Health | To help things work again, treat a sickness, or stop a problem. | Yes | Dental implants, fillings, root canals, crowns on a broken tooth. |

| For Looks Only | To make your smile look better or nicer. | No | Teeth whitening, veneers just for looks. |

How Do You Use Your Flexible Spending Account for a Dental Implant Procedure?

Using your flexible spending account for dental implants is easy to do. Most FSA plans will give you a special debit card. You can use this card to pay for your treatment right there in your dentist’s office. When you pay with the card, the money comes straight out of your FSA. This is the simplest way to use your money. You do not have to use your own money and then wait to get it back. The card makes the payment easy and fast.

If you do not have an FSA debit card, you will have to pay for the service on your own first. You would use your own money, a check, or a credit card to pay the dentist. After you have paid, you will need to ask your FSA provider for a reimbursement. This just means you ask them to pay you back the money you spent. To do this, you will need to fill out a form and turn it in. You also have to show proof that you paid and what service you got.

To get your money back, you will need a special receipt from your dentist called an “itemized receipt.” This receipt needs to show the date you had the work done. It also needs to show what treatment you received and how much you paid for it. Then you give this paperwork to the company that manages your FSA. They will look at your claim to make sure the dental implants procedure is an “eligible expense.” After they approve it, they will send you the money. You do not have to pay tax on this money.

What Is the Correct Order of Steps to Use Your FSA?

To use your FSA for dental implants, it is a good idea to follow a few simple steps. Following them in this order will make things easy and free of stress. You want to be sure you do everything correctly so your claim will be approved.

Here are the right steps to follow:

- Step 1: Talk to Your Employer. First, check with the person at your job who handles benefits. Make sure you have an FSA and ask about your plan’s special rules. They can give you all the details about your coverage and how to turn in a claim. This is a very important first step.

- Step 2: Go to Your Dentist. Next, make an appointment to see your dentist. Your dentist will check your tooth and tell you if a dental implant is the best treatment for you. Ask for a plan that shows all the details of the treatment. This plan should explain the whole procedure and the total price.

- Step 3: Get a Letter of Medical Necessity. You might need a letter from your dentist. This letter should explain why the dental implants are needed for your health. It should say that the treatment is to help your tooth work again, not just for looks. This letter helps your FSA provider approve the expense.

- Step 4: Pay for the Treatment. You can now get your dental implant treatment. You can pay for it with your FSA debit card if you have one. If not, pay for it yourself and make sure you get a detailed receipt.

- Step 5: Ask for Your Money Back. If you paid for it yourself, you need to turn in your claim. Fill out the form from your FSA provider. Attach the receipt and the letter from your dentist. Send in all the papers before the deadline that your plan has set.

Can You Also Use an HSA Account for Dental Implants?

Yes, you can also use a Health Savings Account (HSA) for dental implants. An HSA is another kind of tax-free account for health care bills. Just like an FSA, you can use an HSA to pay for qualified medical expenses. This includes dental work that you need for your health. If you have a “high-deductible health plan,” you might be able to get an HSA. This health savings account lets you save for medical bills and get tax benefits.

There is one big difference between an HSA and an FSA. The money in an HSA is yours to keep. If you do not use it, it moves to the next year. This is not like FSAs, which often have a “use it or lose it” rule. This makes an HSA a great way to save money for health care for a long time. You can save up money over a few years to pay for a big treatment like dental implants.

Both accounts let you pay for the same kinds of dental treatments. The one you choose depends on your health insurance and what your job offers. Both are great ways to help you pay for your dental implant treatment. You should check to see which type of account you are able to get. No matter which one you have, you can save a lot of money. The treatment to get a new tooth can be expensive, so this is a wonderful benefit.

How Much Money Can You Make Available in Your Flexible Spending Account?

The amount of money you can put into your flexible spending account changes every year. The government makes a rule about the highest amount you can put in. Your job might also have its own limit, which could be less than the government’s limit. You should talk with your employer. They can tell you the exact amount you are allowed to put aside. This is an important thing to know for your plan.

When you sign up for your FSA, you must choose how much money to put in for the whole year. You should think about the health and dental costs you think you will have in the coming year. If you know you will need dental implants, you can plan to put enough money in your account to pay for it. This is a smart way to plan your money for the procedure. Do not forget to think about other medical bills you might have too.

It is a good idea to plan with care. You want to put in enough money to pay for your dental implant. But you do not want to put in so much that you have a lot left over at the end of the year. Make a list of all the health care you think you will need. Talk to your dentist to get a clear price for the dental implant procedure. This will help you choose the right amount of money to set for your account. This way, you can get the most out of your tax savings.

What If You Don’t Use the Money in Your Account?

One of the most important things about FSAs is the “use it or lose it” rule. This rule means you must use most of the money in your account before the plan year ends. If you have money left in the account, you may have to give it up. You will miss out on using those funds. This is why it is very important to plan your spending with care.

But today, many employers offer more choices to help you not lose your money. Your employer might give you one of two options. The first is a grace period. This gives you about two and a half extra months after the year ends to use your FSA money. The second option is a rollover. This lets you move some money (up to a certain amount set by the government) into the next year. You should ask your employer if they offer a grace period or a rollover.

To keep from losing money, you should keep an eye on how much is in your FSA all year. If you see you have extra money near the end of the year, you can use it for other things you are allowed to buy. You could get new glasses, have a dental check-up, or buy some first-aid items. Planning ahead helps you use every dollar in your account. That way you will not miss out on your money. The goal is to spend it all on the health care you need.

How Can You Make Sure Your Dental Implants Procedure Is Approved?

To be sure your dental implants procedure is covered by an FSA, the most important thing is to show it is a medical need. The treatment must be for a clear health reason, not just for looks. You can do this by getting the right papers from your dentist. These papers will be the proof for the company that manages your FSA.

Ask your dentist to give you a written paper. This is often called a Letter of Medical Necessity. It should say very clearly why you need the dental implant. For example, it should say that the implant is needed to replace a missing tooth so you can chew correctly. It might also say the treatment is to stop other mouth health problems. This letter is very strong proof that the procedure is not just for looks.

You should also get a detailed treatment plan from your dentist. This plan will show every step of the dental implants procedure. It will also list the price for each part of the service. You can give this plan and the letter to your FSA provider. Sometimes, you might want to send it in to get it approved ahead of time. This will let you know for sure that the expense is covered, so you won’t have to worry.

What Is the First Action You Should Take to Use FSA Funds?

The very first thing you should do is talk to the person at your job who is in charge of benefits. They are the experts on your health plan. They can tell you everything you need to know about your Flexible Spending Account. They will make sure you have coverage. They will explain the rules and tell you how to send in a claim for your dental implants. Do not skip this important step.

Ask them for a copy of your plan papers. These papers will have a list of all the expenses that are allowed. You can check the list to see that big dental work, like dental implants, is on it. They will also tell you about any important dates you need to know. For example, there is a certain amount of time you have to send in your claim to get your money back. Knowing these details first will help you avoid any bad surprises.

After you understand your FSA plan, you can feel good about moving forward with your dentist. You will know exactly what you need to do to use your FSA for dental work. This simple first step will make the whole process much easier. You can then put your thoughts on what is most important: getting your new tooth and making your mouth healthier. Taking this action will help you get the full benefit of your FSA account.

Key Things to Remember:

- Yes, It’s Covered! You can often use your FSA to pay for dental implants. This is because they are seen as a health need to replace a missing tooth.

- Not for Looks. Your FSA will not pay for dental work that is only to make you look better, like teeth whitening. The work must be for a health or functional reason.

- Ask Your Employer. Always check the rules of your FSA plan with your employer. They can tell you how much money you can put in and how to send in a claim.

- Get Your Papers. Ask your dentist for a Letter of Medical Necessity and a receipt that lists all the costs. This will help make sure your claim for the dental implant is approved.

- Plan Your Money. FSAs often have a “use it or lose it” rule. Plan how much money you will put in your account. This way, you can pay for your dental implants and not have money left over at the end of the year.